10 Trends of 2014 You May Have Missed

No, I’m not talking about wearable tech, the ice bucket challenge, or Radiant Orchid (PANTONE’s 2014 color of the year). The trends that busy healthcare CIOs like you value most are the ones that will impact how you are able to do your job. And having spent the last year conducting over 18,000 interviews with healthcare providers and leaders just like you, KLAS is in a unique position to identify those trends.

1. IT'S THE END OF THE WORLD AND I FEEL FINE?

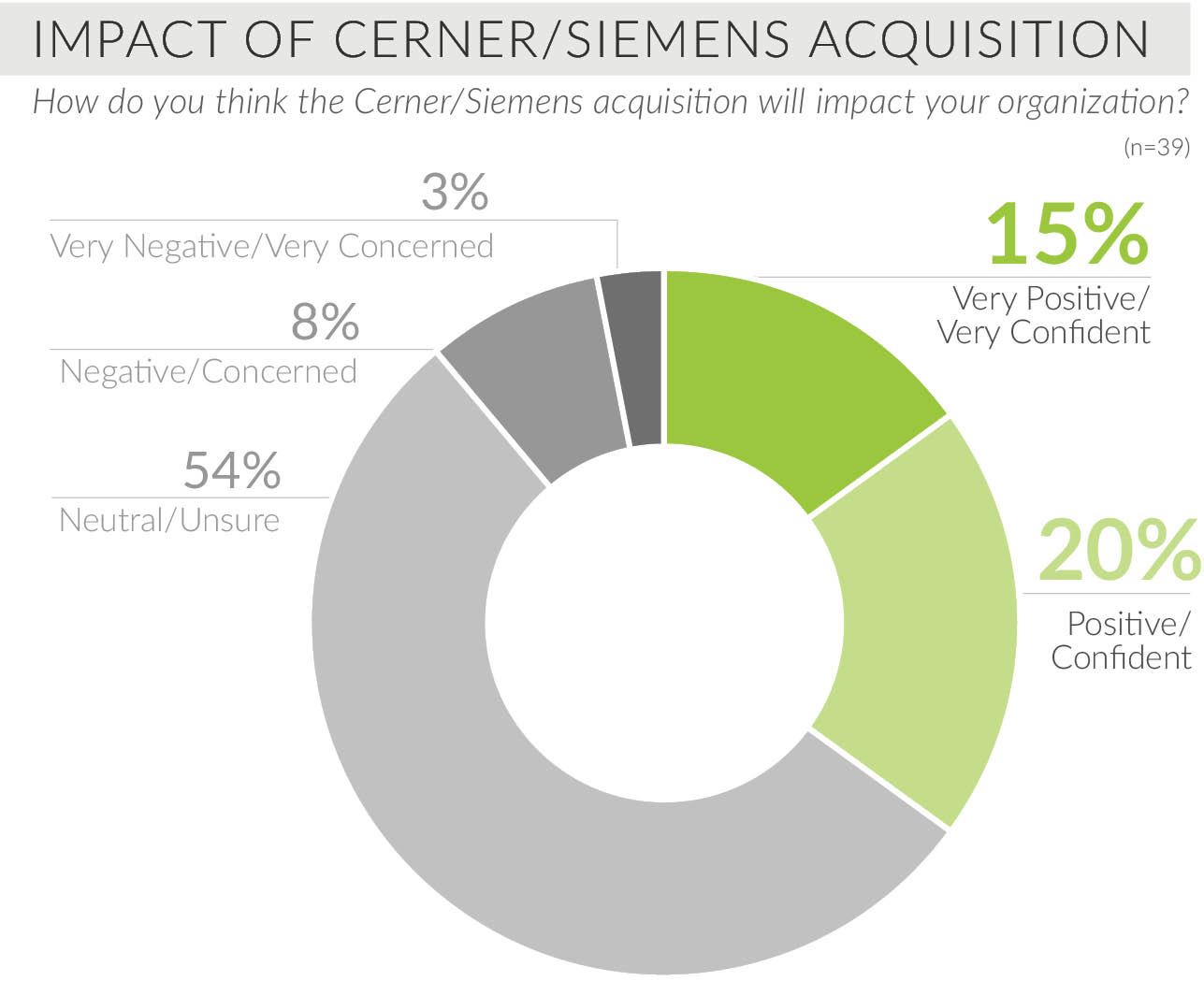

Imagine investing millions of dollars into a vendor and solution, only to find a few years later that the vendor has been sold and that your product will not be the long-term go-forward solution. After Cerner’s acquisition of Siemens’ HIT holdings, this is now the scenario that Siemens customers are facing. The news was a surprise to many, but what has been even more unexpected is how Siemens customers have reacted. Instead of running around in a panic, most are okay with, or even excited about, the news.

In the words of one CMIO, “Really what has happened with Siemens has been the end of the world, but so many of the Siemens customers are happy about being sold to Cerner because we had completely lost trust in Siemens and feel optimistic that Cerner knows what they are doing.”

That CMIO is not alone. In some recent research (not yet published) that KLAS conducted with Siemens-customer executives, 90% reported an expectation that the acquisition would be a positive or neutral event for their organization.

2. PHYTEL AND POPULATION HEALTH: A GOOD START

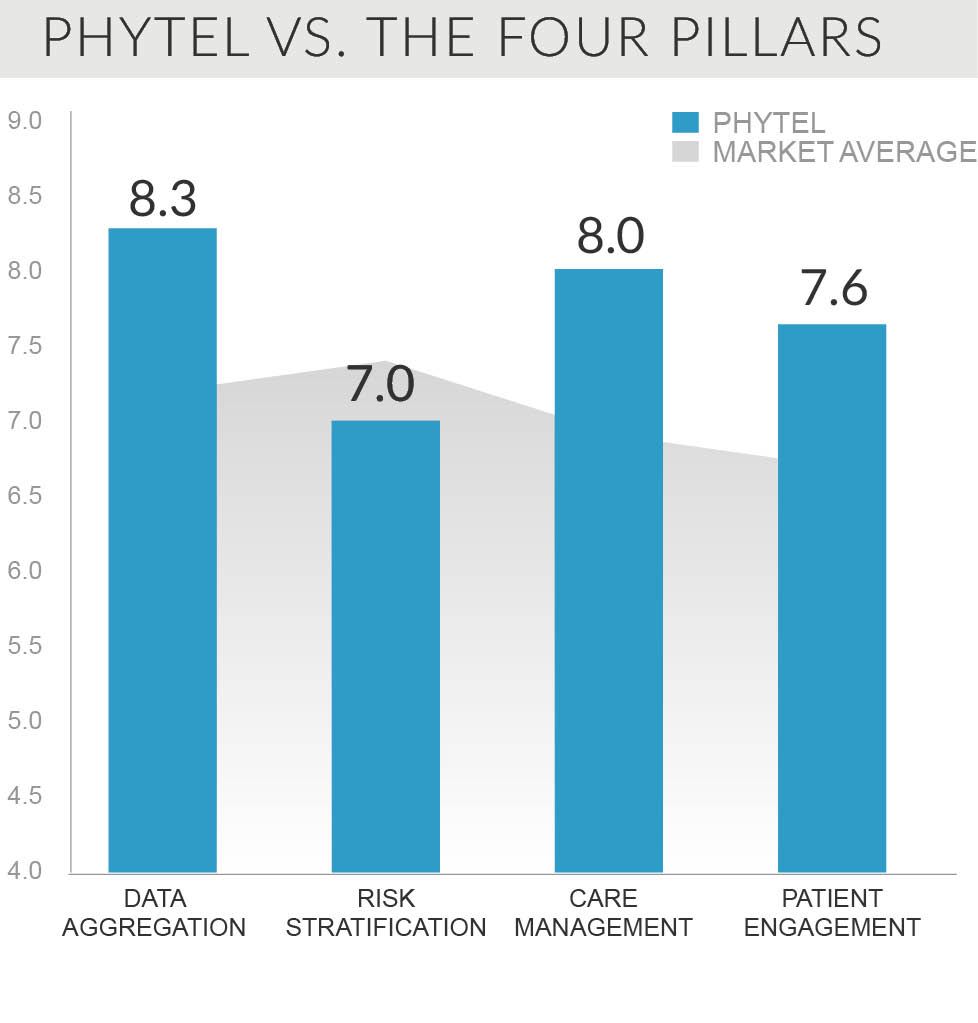

Population health IT is hard and complicated—in large part because it means something different to everyone. Given the difficulty in this space, it was not a surprise to KLAS that our 2014 population health report sold more copies than any report in KLAS history—before it was even published!

What was a surprise to us was that we were able to identify an early leader. In the last year, it seemed like customers could easily identify a downside to every offering (in experience, slow support, lacking functionality, etc.).However, with strong customer satisfaction, a growing customer base, and strong care management/patient outreach, Phytel received glowing reviews from their customers.

While we were all enthused by Phytel's strong performance, we couldn’t help but remember that Axolotl and Medicity both showed up as early leaders with high satisfaction scores in the2010 KLAS HIE study. Almost five years and two acquisitions later, both products are currently scoring well below average. We hope that Phytel can surprise us again by showing that early leadership can be followed by long-term consistency.

3. AMBULATORY CHANGING OF THE GUARD

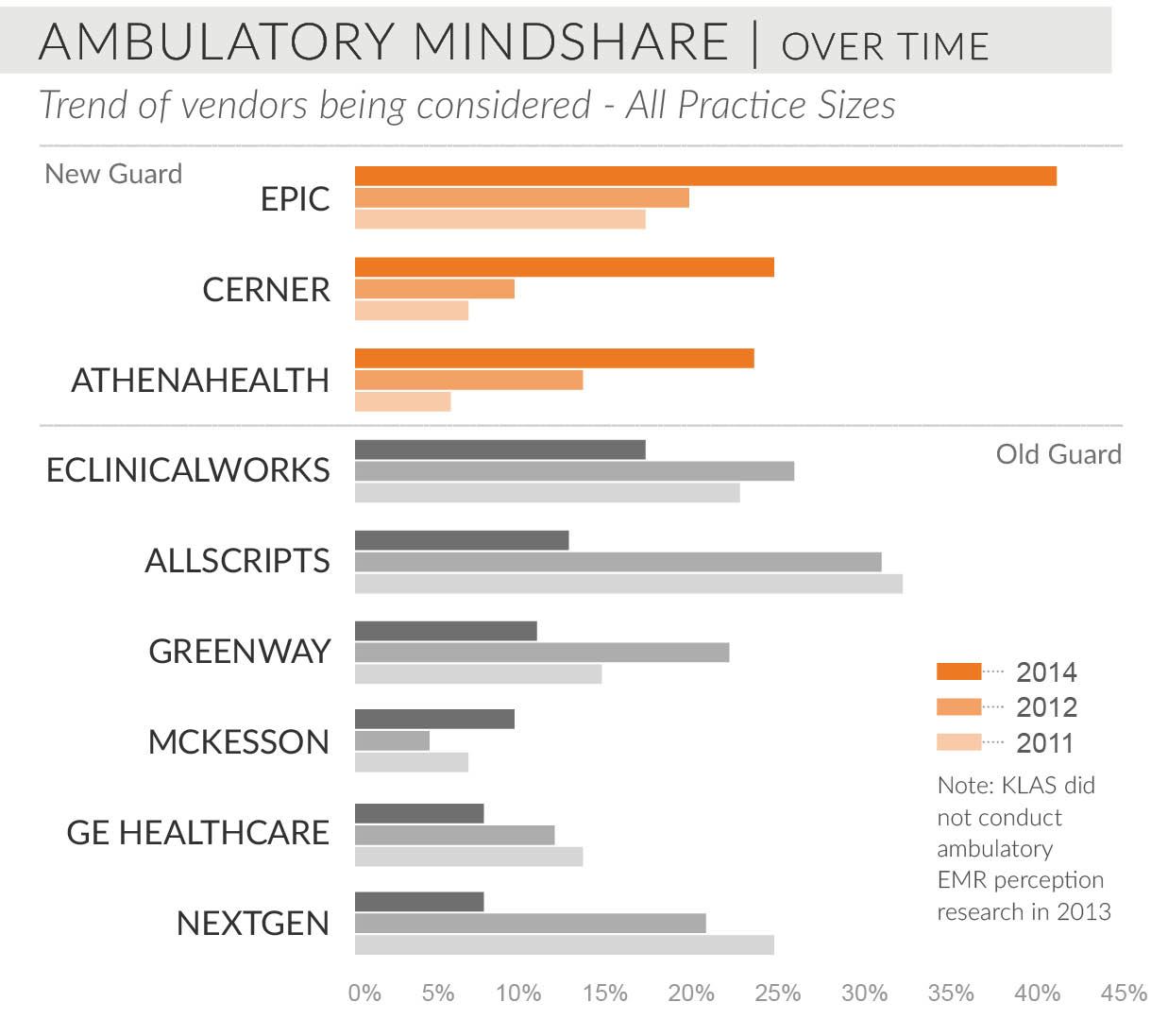

KLAS has been publishing research on buying trends in the ambulatory EMR market since 2006. With the profusion of ambulatory EMR options, KLAS has seen vendors come and go in eight years. But despite the revolving door, one might expect that surely the market sales leaders have stayed somewhat consistent.

Between 2006 and 2010 that was true. Allscripts, NextGen, and eClinicalWorks were all top considerations by providers in both 2006 and 2010. In fact, in 2010, KLAS started to question whether we should keep studying buying trends since there was little change. Fast forward to 2014 and everything is different. Today Epic, Cerner, and athenahealth have replaced the previous mindshare leaders.

Clearly a trend toward integrated solutions across the continuum has driven much of this change (especially with Cerner), but it would be hard to argue that Allscripts’, NextGen’s, and eClinicalWorks’ below-average satisfaction scores have not also impacted buying trends.

4. BI: WHO IS REALLY DOING THE LIFTING?

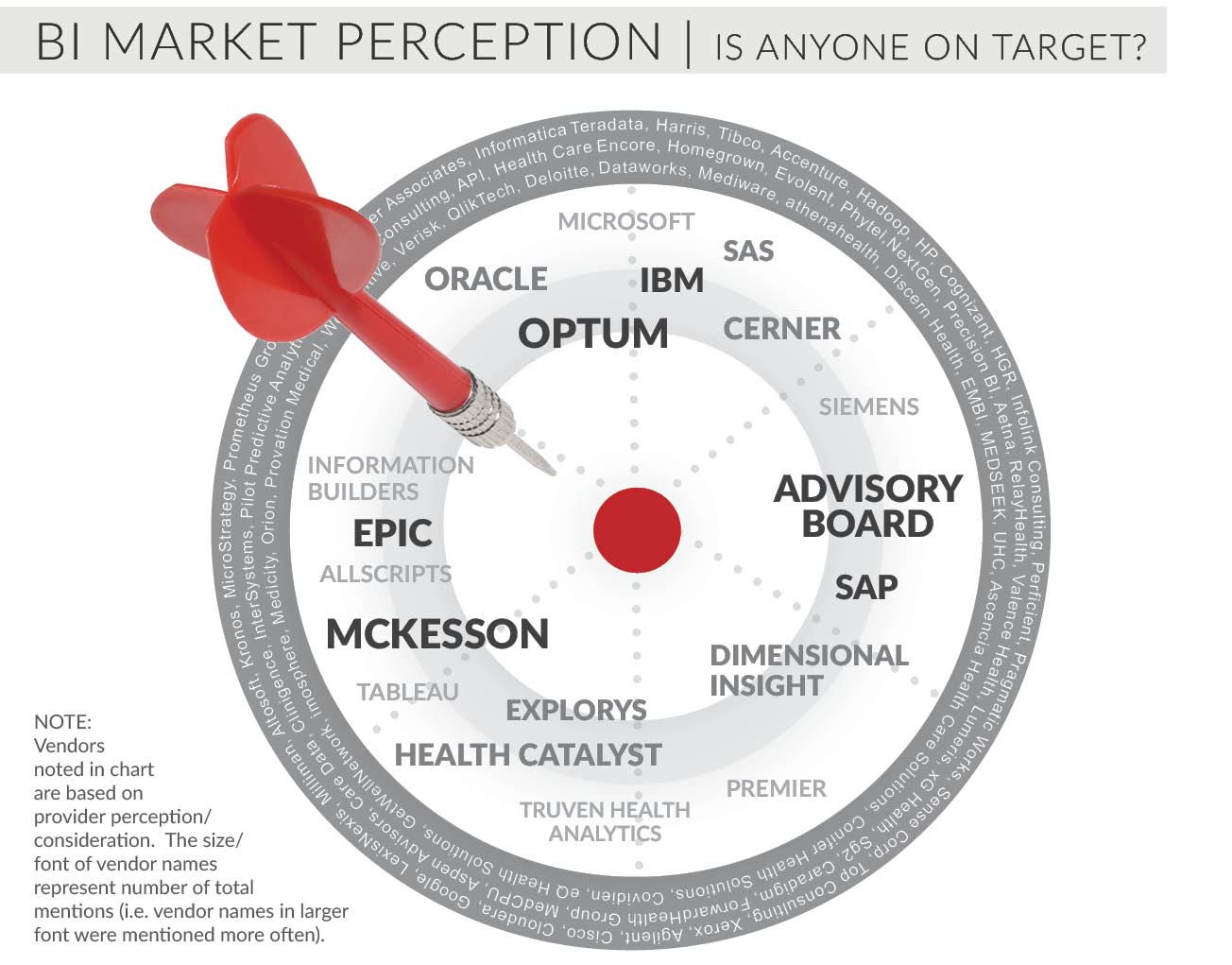

If you need a refrigerator or piano moved, it is usually a good idea to find movers with exceptionally large biceps. You would feel pretty confident if Dwayne “The Rock” Johnson showed up to help you move.

Over the past several years, many providers have searched out massive, cross-industry hulks to help them with their BI needs. Unfortunately, providers too often report that the BI “movers” with arguably the strongest muscles (e.g., IBM, SAP, Oracle, and Microsoft) are not always moving their organization’s BI goals forward as expected. So who is doing the heaviest lifting? In a recent BI mindshare report, KLAS reported that no vendor has earned the status of being the clear mindshare leader. One finding, however, was clear: those industry hulks have opened the door for some exciting competition. Interviewed providers mentioned a total of 87 different vendors that they were considering for their BI needs!

While it still might not be a good idea to recruit your pencil-neck neighbor the next time you move, companies like Dimensional Insight, Tableau, Health Catalyst, and Qlik are making it clear that BI vendors don’t have to have a market cap of over $100 billion to really help their customers. The success of these smaller vendors might even make people wonder whether all those big muscles just get in the way.

5. EPIC'S WEIRD COMMUNITY MODEL ACTUALLY WORKS

The expression “One throat to choke” is often reported by providers as the reason they want their software vendor, not a third party, to host their applications. Maybe it is not a coincidence that the two top-rated application hosting vendors (Cerner and Siemens) both primarily host their own software.

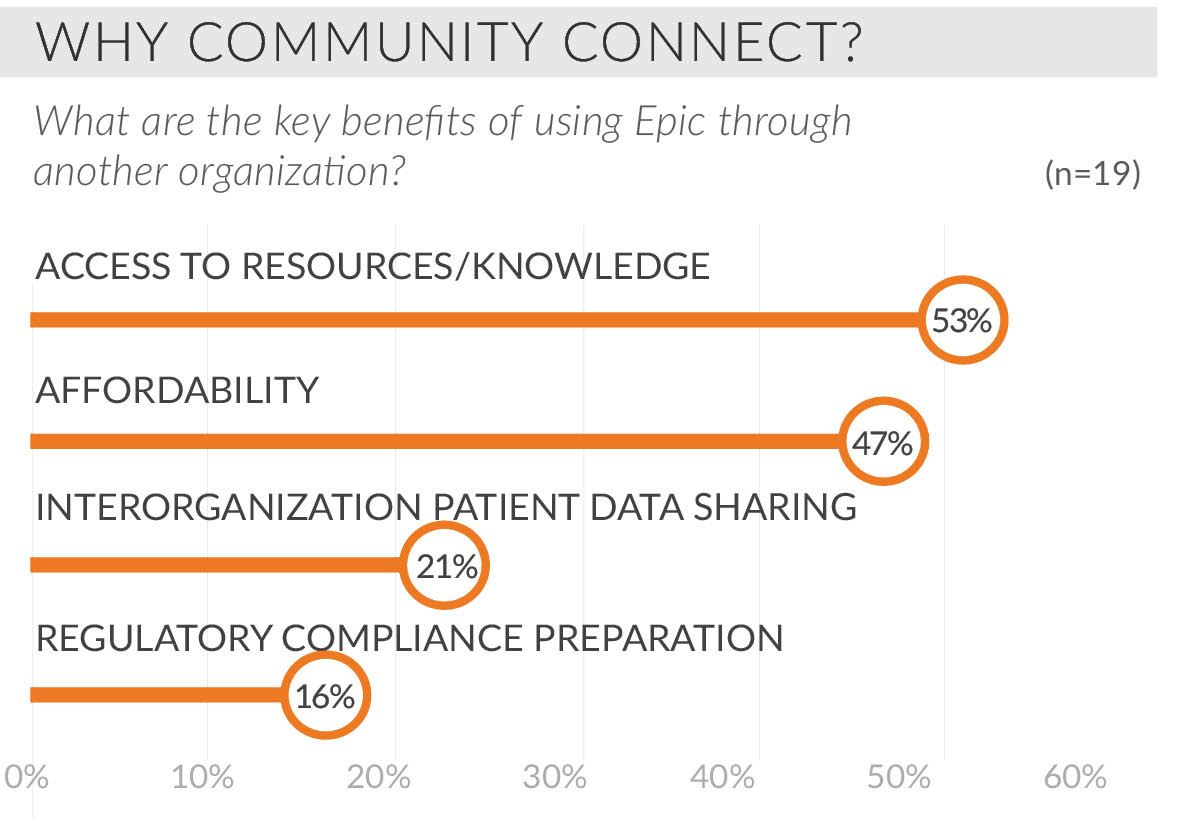

Given how common this single-vendor logic is in the industry, many providers reported skepticism to KLAS when they first heard about Epic Community Connect—Epic’s two-year-old program that allows larger health systems to host the Epic solution for hospitals that Epic would not normally sell to. Definitely a revolutionary model for healthcare.

Can smaller hospitals handle the complex EpicCare inpatient system? Will larger health systems support their smaller “customers” well? So far, the answer turns out to be yes. Most interviewed providers participating in this arrangement reported that they are still in a honeymoon phase, but almost all reported optimism that Epic Community Connect will be a very good long-term fit. With a price tag sometimes less than that of Healthland or CPSI (depending on the hosting institution), Community Connect is turning heads.

6. CAC: CAN THE MIRACLE SCALE?

Some things just fall apart when they get too big. Sandcastles. The U.S. housing bubble of the 2000s. CAC vendors?

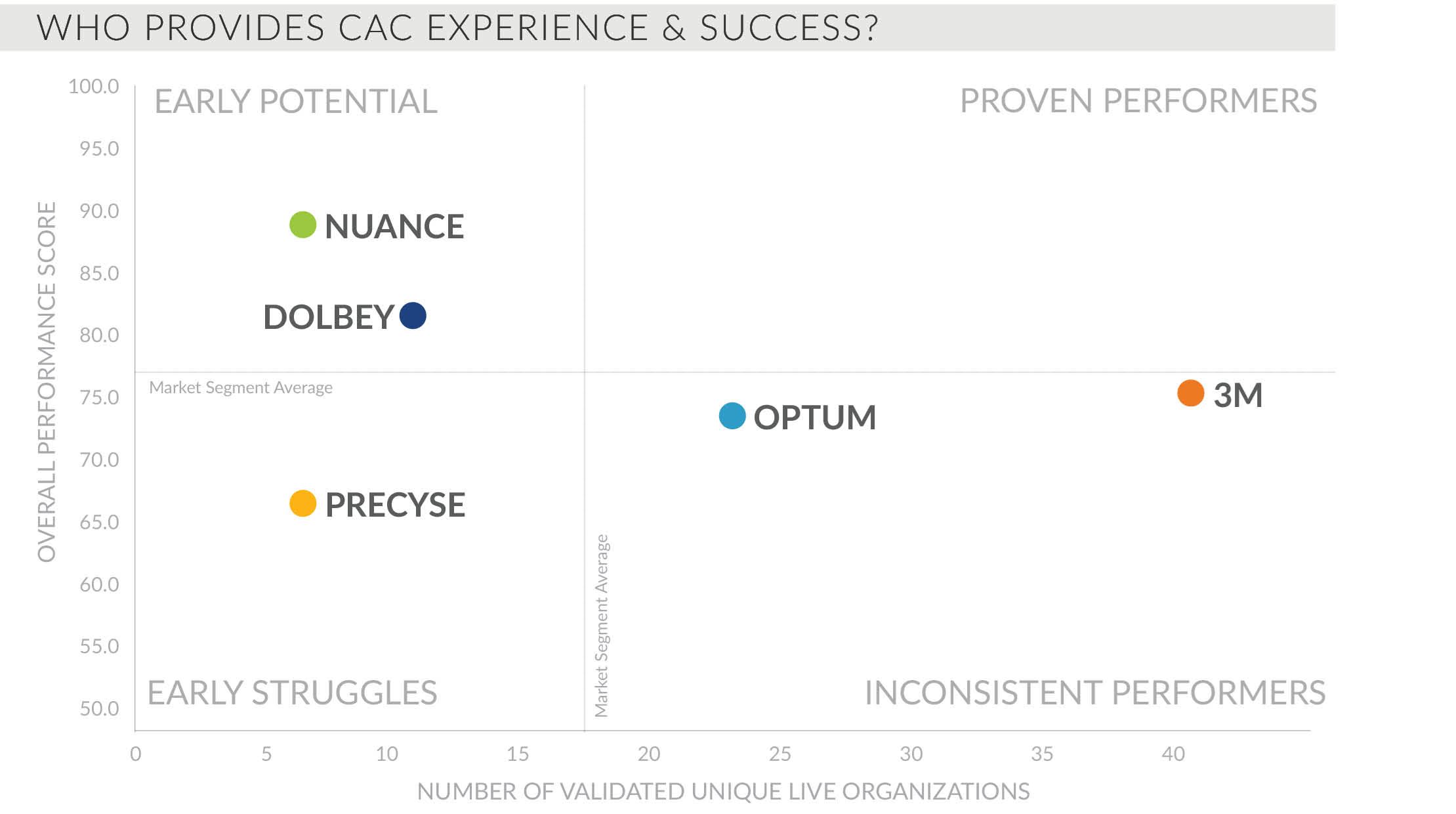

When KLAS started measuring live sites using computer-assisted coding (CAC) products, the early feedback was exciting and positive. In November 2012, customers rated 3M’s CAC product an A.

Today, they give it a C, with ratings continuing to fall as customers report stretched support and interface challenges. The other vendor with significant market share and experience, Optum, rates a C as well, with a score just behind 3M’s.

The good news? Nuance rates a B+, with customers extolling the benefits of receiving the strong support, technology, and help they need. The problem is that Nuance has only a handful of customers.

It seems that no CAC vendor has discovered the formula for consistent, successful growth. There can be no doubt, however, that the vendor who does so will see an incredible flood of customers—because one other thing that does not scale is having to hire an endless number of coders for the ICD-10 transition.

7. IS MAGIC POWERED BY MAGIC?

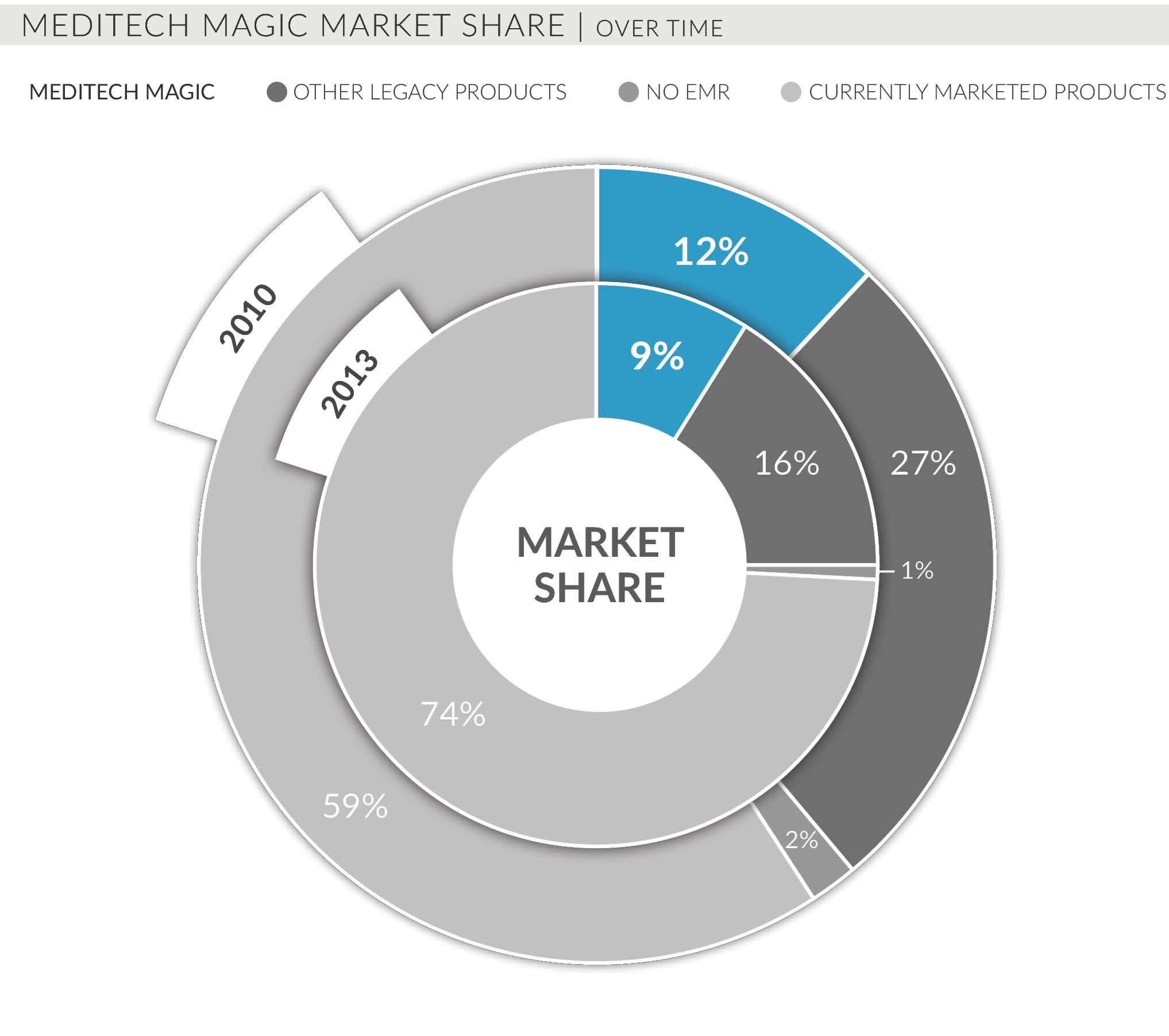

Many MEDITECH competitors have reported to KLAS an expectation that MEDITECH’s older, character-based version—MAGIC—would soon run out of gas as it tried to climb the mountains of meaningful use. However, with over 400 hospitals still running MEDITECH MAGIC and over one-third of these not even considering replacing it, perhaps 30-year-old MAGIC is running on magic.

One MAGIC customer recently reported, “They [MEDITECH] tell us we have to upgrade to 6.0, but we really don’t see much difference in the platforms. It is just a newer user interface, but not worth the pain or the money to make the change.”

While MEDITECH has lost some market share over the past several years, their customer retention, despite a lack of compelling newer technology, is a case study in trust. 96% of MAGIC customers report that MEDITECH keeps their promises, even if they are sometimes slow to do so. Case in point: MEDITECH has promised to not sunset MAGIC, and they continue to make good on that promise.

What does the future hold for MEDITECH customers? While some say they won’t wait for MEDITECH’s ambulatory development (promised to be released in 2015), most continue to hope for a stronger ambulatory solution and greater usability. In the meantime, they are willing to do what people do with someone they have trusted for many years: be patient.

8. THE KLAS REPORT YOU DIDN'T KNOW EXISTED

KLAS currently measures the performance of over 1,000 software products, services, and medical and imaging equipment. Why the italics? Many providers that KLAS interacts with have no idea that KLAS monitors markets for things like smart pumps and revenue cycle outsourcing.

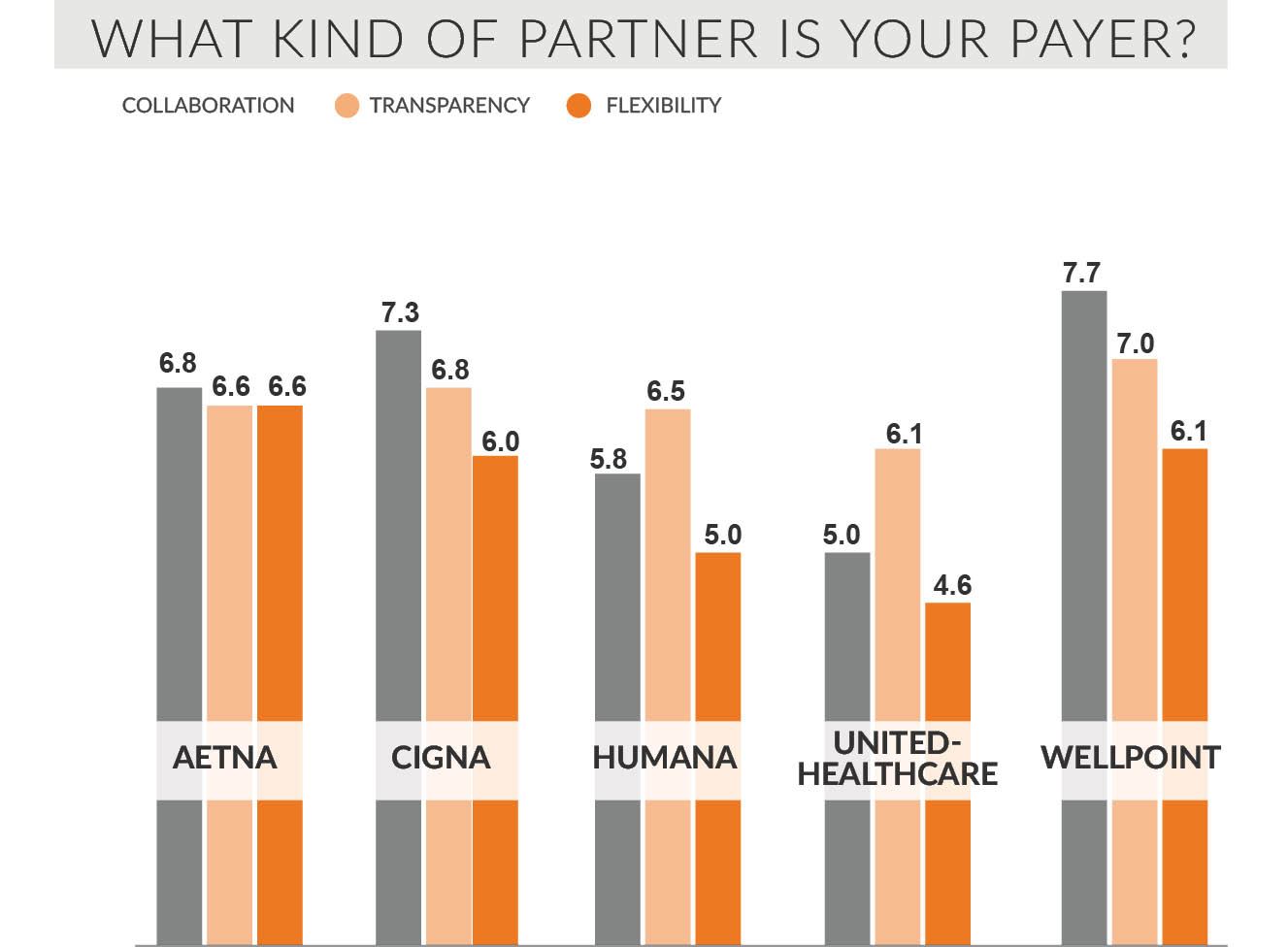

If this is news to you, then you might beeven more surprised to find that KLAShas measured for two years running the cooperation of national payers in new risk-based contracts with provider organizations.

If you want to know why Aetna has been rated the most innovative and Wellpoint the most collaborative, you might find value in reading the KLAS ACO payers report. We can hardly wait for next year’s report because we have no idea what it will look like! Right before our eyes we are watching payers turn into healthcare providers and healthcare providers turn into “payviders.”

9. THE KLAS REPORT WE DIDN'T PUBLISH

We wanted to publish a report about how healthcare organizations that are looking for a new patient billing solution have tons of great options. The only problem: it would not have been true.

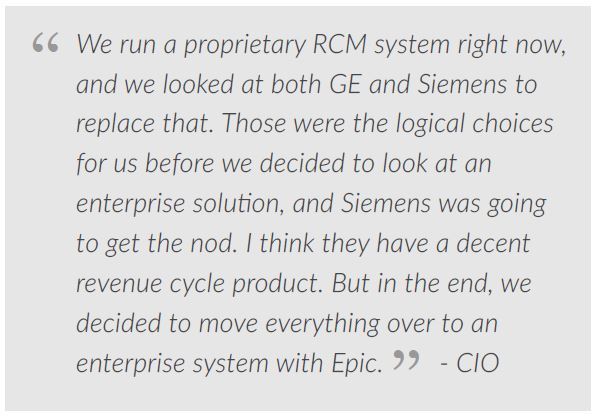

While Epic’s patient billing solution has made various newspaper headlines in the past 18 months, the truth is that many organizations looking to replace their system see Epic as the only proven option (though it is only an option for Epic clinical customers). Allscripts’ newest solution is in its infancy. McKesson and MEDITECH are not known for large, organizational efficiency. Cerner Patient Accounting is starting to mature (after 15 years), but satisfaction ratings have yo-yoed based on the availability of knowledgeable support resources. Siemens Soarian has a question mark over its head given the recent acquisition news. GE and QuadraMed are seeing almost no sales of their experienced, standalone products.

So in the absence of a third-party market, an inpatient clinical decision today is also a revenue cycle decision. That is, unless you want to keep the system that your great-grand predecessor bought before you entered elementary school. However, as unappealing as that sounds, going that route might not be the craziest option since you will be in good company with the over 1,000 hospitals still running legacy revenue cycle solutions.

10. INTEROPERABILITY AND JUNIOR HIGH BASKETBALL

For anyone who has both attended a junior high basketball game and seen an NBA game, it is hard to believe that NBA players were at one point as unskilled as those on a junior high team. If we define interoperability as the ability to accurately and quickly share virtually any component of a patient’s record with another healthcare provider organization through a simple-to-set-up connection (plug and play), then interoperability is definitely at the junior high level today. Even the simplest connections require careful setup and ongoing scrutiny.

Every relevant vendor has built software to push, request, and receive patient information at some level. But the existing standards leave room for misinterpretation or are missing the definition and utilities necessary to make sharing patient data transparent. That process always requires customization and tweaking at some level.

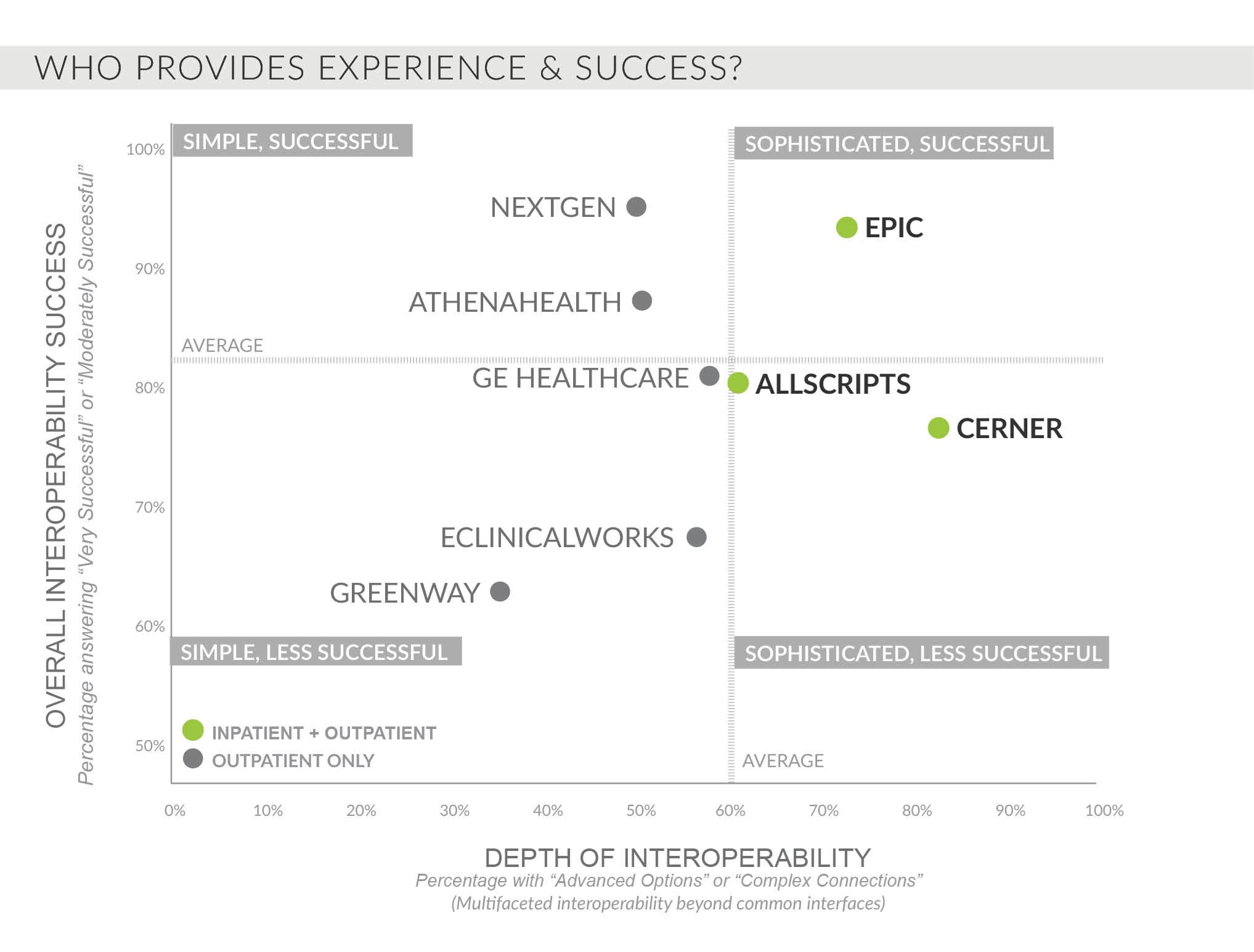

In 2014 KLAS made our first substantial efforts to measure vendor interoperability by measuring the complexity of current connections as well as how successful customers felt. The surprise? The ability to build complex connections is not always synonymous with success. While Siemens and Cerner customers reported the most complex connections, they were also more likely to report feeling less successful with interoperability. MEDITECH, NextGen, and athenahealth customers reported less complex connections but higher satisfaction. Epic customers reported both satisfaction and fairly complex connections.

Why is connection complexity not in line with customer perceptions of success? Perhaps it is similar to a junior high basketball game. While the teams might be able to make enough baskets to win a game, the onlookers know they are watching something very unsophisticated, something that could be so much better.

There is no doubt that the whole industry has room to improve with interoperability. In 2015, KLAS will delve deeper into this messy subject and work to highlight performance so that it can improve. We encourage you to help us define, measure, and report to the industry your vendor’s interoperability performance.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.