2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

CDS Surveillance 2013

Impacting Outcomes

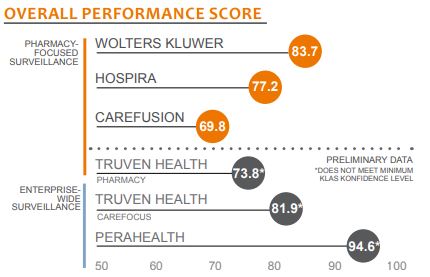

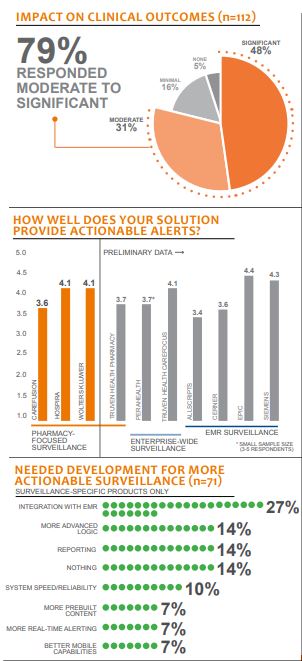

As clinical outcomes are being readily tied to reimbursement, surveillance tools have continued to expand in breadth and depth of usage. KLAS defines surveillance as solutions that monitor patient parameters and call attention to pertinent changes in patient conditions in order to facilitate early interventions by clinicians. Many providers are using third-party products while others are opting to leverage their EMRs. KLAS interviewed over 140 providers using surveillance specific products or surveillance functionality within their EMR to better answer the following questions: How big of an impact is surveillance having today? How capable are these systems out of the box? How easy are they to customize?

WORTH KNOWING

Surveillance Positively Impacting Outcomes—Nearly all Epic, Hospira, and Wolters Kluwer users reported a moderate to significant impact on clinical outcomes, including decreased length of stay, antibiotic usage, medication costs, and adverse reactions as well as better IV-to-PO conversions. Truven Health CareFocus, a preliminary product, also had very positive reports. A majority of Cerner and Allscripts customers also reported a positive impact, albeit to a lesser degree.

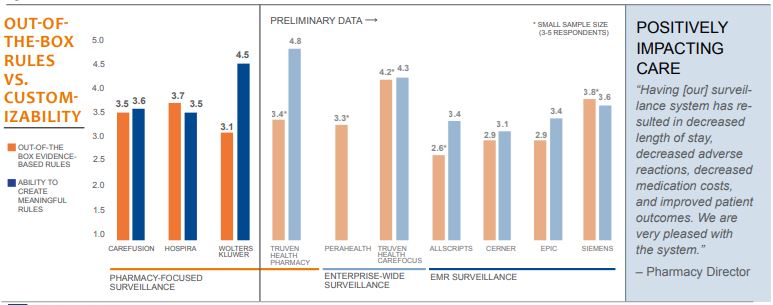

Siemens and Hospira Lead in Out-of-the-Box Functionality—Though these two vendors lead, users of all surveillancespecific and EMR products wanted more out-of-the-box functionality. Siemens’ model content with prebuilt workflows is easier to adapt to providers’ environment. Hospira offers the most prebuilt rules, though many find that the rules are basic and need retooling. Truven Health’s preconfigured profiles within CareFocus were also rated highly, albeit from a limited sampling. Cerner, Epic, and Allscripts rated lowest for out-ofthe-box surveillance content.

Best-of-Breed Vendors Wolters Kluwer and Truven Easiest to Customize—Wolters Kluwer and Truven Health (both Pharmacy Intervention and CareFocus, which are preliminary products in this study) rose to the top for providing easy-to-configure rules that require little training and minimal IT involvement. No EMRs excelled in customizability, instead needing extensive IT custom work to create rules.

Epic and Siemens Provide More Actionable Alerts —Third-party products rated lower , since they provide passive alerting dashboards with some email and pager alerting. Epic rated highest thanks to the alert logic built into clinician workflows, though some reported a fine line in avoiding alert fatigue. Siemens was a close second, and clients like the flexibility in sending alerts to clinicians (via pop-up, email, or pager). Of all vendors, CareFusion, Cerner, and Allscripts rated lowest for actionable surveillance alerts.

Bottom Line on Vendors

PHARMACY-FOCUSED SURVEILLANCE PRODUCTS

CareFusion—Provides good, basic out-of-the-box rules used mostly for passive alerting via dashboards. Some use email alerting. Of respondents, 82% feel it has a moderate to significant impact on outcomes. Can be difficult to create custom rules, so some providers rely on CareFusion’s support for help. Lowest rated for support, and over 50% report product does not have needed functionality.

Hospira—Provides a lot of prebuilt rules. Nearly 90% report system has moderate to significant impact on outcomes. Many users are able to send critical alerts to pagers and email in addition to a standard surveillance dashboard. Customization rates on the lower end as it requires specific terminology/structure. Customers want better EMR integration, but most are confident Hospira will deliver. Average support.

Truven health Pharmacy—Provides some basic prebuilt rules but is easy to customize. Used mostly by Siemens customers. Good at interfacing. Customers want better retrospective reporting on interventions and better system speed when loading patient information. Customers confident Truven Health will make these changes.

Wolters Kluwer—Highly customizable, easy-to-use product. Highestrated support. Little to no out-of-the-box rules offset by ease of creating custom rules. Customers using passive alerting dashboard. None reported using active alerting methods like emails or pages. Often limited in usage to single department at a single facility.

ENTERPRISE-WIDE SURVEILLANCE PRODUCTS

PeraHealth—Customers very pleased with product and accompanying support. Unique trending dashboard helps customers quickly see patient status. Only two of six said this had a moderate to significant impact on clinical outcomes. Customers want more information on clinical and financial impact.

Truven Health CareFocus—Highly rated for out-of-the-box rules, customizability, and interfacing. Nearly 90% report moderate to significant impact on outcomes. Customers would like better retrospective reporting, but 80% are confident Truven Health will make the enhancements they need.

EMR VENDORS

Allscripts—Little out-of-the-box surveillance functionality. Very configurable alerting requires intensive IT resources. No customers report using a passive alerting dashboard showing patient status. Second-lowest percent (60%) of customers report surveillance efforts have moderate to significant impact on outcomes.

Cerner—Sepsis alerting a notable exception to limited prebuilt surveillance functionality. Requires a skilled IT team to create custom content. Customers who have spent more effort building content note significant impact on clinical outcomes and timely interventions. Nearly half want easier customizability for surveillance.

Epic—Very good workflow alerting functionality—rates highest for actionable alerts. Customers point to a number of improved clinical outcomes. Customers provided a model system for reference, but building surveillance content is very complex and requires specially trained IT staff. More prebuilt rules, better customizability, and more advanced alerting logic are top customer requests.

Siemens—Highest percent of customers (two-thirds) reporting significant impact on outcomes. Provides more surveillance content than most out of the box. Customizing requires help from trained individuals, which can be difficult to find. Customers using pager, email, phone, and dashboard alerting.

McKesson/MEDITECH—Not a focus for this research as providers of these core EMRs were typically using third-party surveillance products.

Writer

Jonathan Christensen

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.