Where does Investment Fit in Healthcare? A HCLDR Recap

Recently, I had the opportunity to co-host the weekly HCLDR tweetchat. This week’s tweetchat was centered around investing in healthcare. On the off chance you missed that conversation, let me bring you up to speed.

I wanted to share the topics discussed during the tweetchat, my insights, and my favorite responses.

Topic 1: Where is investment most needed in healthcare?

To me, it seems that patients first and foremost need consumer-minded investment. I can’t think of anything more needed than a price transparency toolset.

As healthcare costs continue to rise, patients want to feel that they’re able to engage in traditional consumer cost-saving practices.

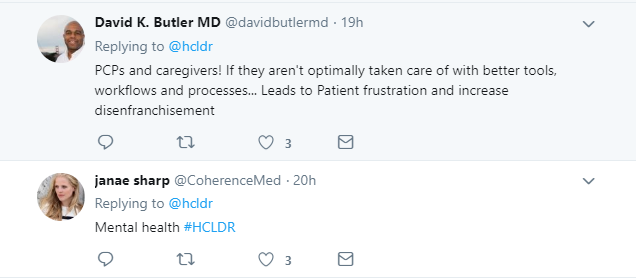

Others suggested that caregivers and PCPs need investors to fund tools that will revolutionize their workflows. Janae Sharp, however, suggested a field that really struck a chord with me:

KLAS only recently began measuring IT in the mental health space. This is partially because mental health providers don’t have the same depth to their IT infrastructure as traditional healthcare providers. Behavioral healthcare didn’t see the same influx of cash through meaningful use, making it almost a time capsule of predigital healthcare in the US.

As healthcare continues to blur the line between mental and physical health, it will become vital to invest more deeply in tools that enable behavioral care.

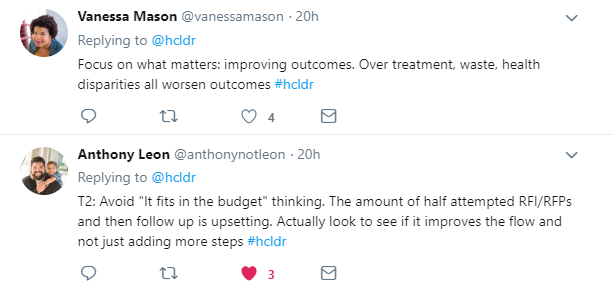

Topic 2: How can we avoid making investments that hurt healthcare?

Often, investments that focus on short-term gains lead to decisions that benefit shareholders over providers. In particular, slash-and-burn investments can leave providers with long-term aches due to broken, underdeveloped platforms.

Additionally, I think smart acquisitions can set up providers and vendors for success. There have been many cases where a market-share-motivated acquisition left thousands of providers struggling on unsupported systems. These disgruntled providers often move to new platforms, frustrated at the acquirer for their lack of support.

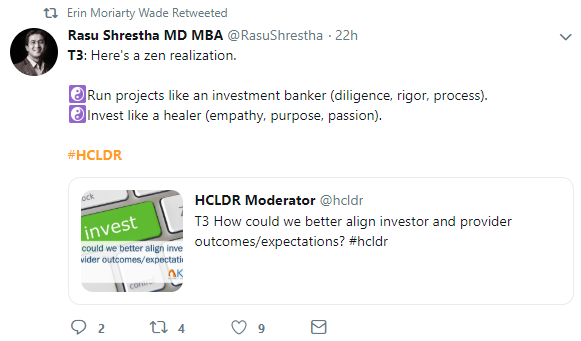

Topic 3: How do you better align provider outcomes with investor expectations?

As W. Edward Deming is attributed to have said, “In God we trust. All others must bring data.” Aligning outcomes means reaching an agreement—in other words, negotiating. Aligning outcomes and expectations between investors and providers becomes much simpler when you’re all working from an agreed-upon data set.

I also appreciated the insights from Dr. Shrestha of UPMC, who spoke as a Chief Innovation Officer with more than a few years of investing experience.

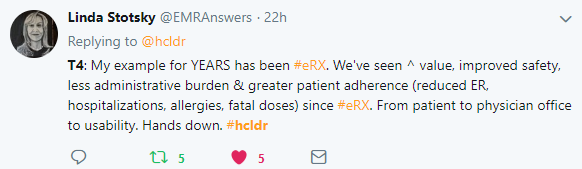

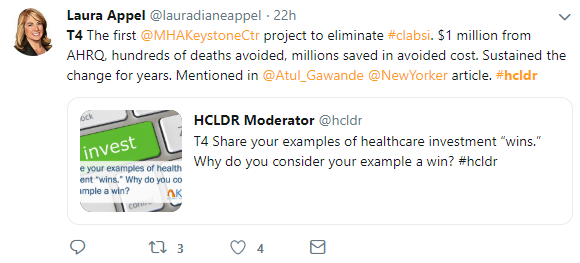

Topic 4: Share your examples of healthcare investment “wins.” Why do you consider it a win?

Thankfully, the tweetchat group was not bereft of successes. While talk of money can often feel unsavory, I was delighted to see several examples of the marriage of technology and capital leading to great patient outcomes.

For me, exciting investments aren’t always the typically “VC fund bolstering a startup.” Personally, I get really excited when consumer technology giants (Apple, Amazon, Google, etc.) make moves into healthcare. Things like the personal health record app and Amazon’s purchase of PillPack feel like great steps forward.

Skeptics abound when these large companies circle the healthcare industry. Is it all smoke and mirrors? Maybe. But I am hopeful that these giants will scare the comfortable HIT incumbents into innovating.