US Hospital EMR Market Share 2019 Report

While the Acute Care EMR market is one of the more stable segments in healthcare IT, it still has plenty of vitality. In fact, 2018 saw more EMR purchases than either of the previous two years. KLAS has plenty of details in our US Hospital EMR Market Share 2019 report.

I love this report because win-and-loss data is, in many ways, the bottom line. It gives us a clear picture of provider organizations’ priorities and how the organizations feel about different EMRs and vendors in the market.

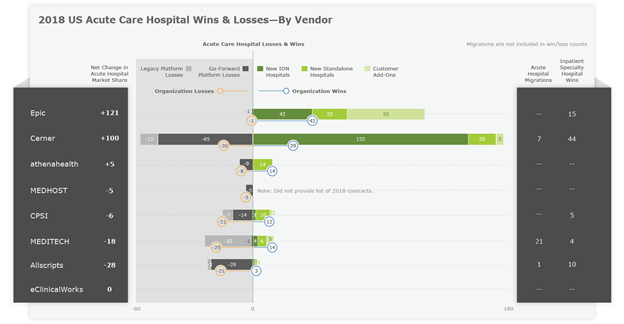

The following chart shows the 2018 market share for acute care hospitals in the US:

While the chart is enlightening, it’s far from the complete story. Many other charts and specifics can be accessed in the report. However, I’m excited to share a few of the high-level findings from the report and get you excited to learn even more.

Who Signed the Most New Hospitals?

Over the past five years, 39% of Cerner’s hospital wins have been from government contracts. 2018 was a good example of that trend. The finalization of their VA deal (167 hospitals) helped Cerner take first place in the number of new hospitals gained in 2018.

However, that wasn’t enough to get Cerner the highest net market share gain. This honor went to Epic. They signed fewer hospitals than Cerner, but while Cerner lost 65 Millennium hospitals in 2018, Epic had only a single organization loss in 2018.

Where Is the Market Energy?

Not many multihospital systems or hospitals with 500+ beds made buying decisions in 2018, but purchasing energy has been relatively high for small standalone hospitals. The report includes the fascinating five-year trend of market share data for hospitals with fewer than 500 beds.

Certain tools are also garnering significant attention. Several non-MEDITECH provider organizations chose to go with the web-based Expanse tool in both 2017 and 2018.

In addition, athenahealth’s updates to their hospital product have a number of customers excited for the future. Others are more skeptical, noting that athenahealth has stopped responding to RFPs and not said when they plan to start up again.

Allscripts saw significant losses in 2018 while other venors were more stable. .

What Are the Reasons Behind EMR Decisions?

Mergers and acquisitions (M&A), as well as customer standardization, are leaving their mark on the EMR market. Certain vendors have been hit harder than others. For instance, Cerner has lost 73 Millennium customers in the past five years because of M&A and standardization; athenahealth and Epic have lost only three customers apiece for those reasons.

Of course every CIO would like their hospital to be on the same EMR as the other facilities in the organization. But they also have increasing desires to be on the same EMR as neighboring organizations. Today, an EMR’s functionality may matter less to a healthcare IT leader than whether the vendor has a strong presence in the region.

So far, Epic has benefitted the most from these market forces. However, several vendors appear to have an advantage in at least one geographical area of the US.

Reference Points for Future Decisions

Choosing an EMR is an intimidating prospect to say the least. But healthcare IT leaders can take comfort in knowing that they can use the choices of fellow healthcare organizations as reference points. Take a look at the US Hospital EMR Market Share 2019 report and see what you can learn about the vendors and EMRs on the landscape today.

Photo Cred: Shutterstock, Stasique