What We Learn from the Acute Care EMR Decision Insights Report

We’ve published a lot of information this year dealing with questions surrounding acute care EMRs. We published the US Hospital EMR Market Share report, which talked about what happened. It looks at which vendors were replaced and which were given business. The Emerging Acute Care EMRs report talked about other vendors that providers might want to pay attention to. The data in that report primarily deals with new up-and-coming vendors and products.

With our recent Acute Care EMR Decision Insights report, we hoped to answer the why. Why are people making the decisions they're making? Why are people buying certain solutions but not others? Although it wasn't designed this way from the beginning, we now have a nice three-part series of what customers bought, what some of the up-and-coming solutions are, and why people made their buying decisions.

Replacing Legacy Solutions

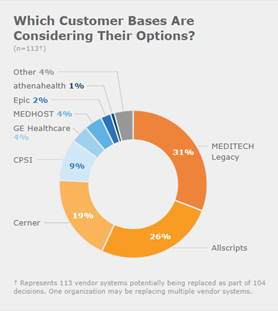

There is a sense out there that people stay with their current vendor or look only at one or two vendors when looking to replace old technology. That's not actually true. Providers are looking at the whole landscape before making decisions. They might quickly narrow their choice to two or three vendors, but there's a chance for many options out there, depending on the size and complexity of the deal.

One reason to look at multiple vendor options is the expense and effort it takes just to upgrade.

For example, a legacy customer wants to upgrade to the most recent solution. They realize that if they're going to upgrade, then they will have to also upgrade all their hardware. And that means they will probably need to upgrade all their operating systems. Then there's a whole new learning curve, in addition to hardware and software expenses and implementation expenses.

When they start to lay all the details out like that, providers see that if an upgrade is going to take that much effort, then they might as well look at other vendor options too.

The New Base Level of Expectation

When I bought my first car, it did not have an air conditioner. My second car did, and I have expected every car I’ve had since then to have air conditioning. Because I have experienced it, I can no longer live without it. In the same way, we found in this report that an integrated solution is now the minimum viable product. In this case, integrated means that the hospital acute care system is fully integrated with the ambulatory system; they share one data record.

Integration has been the selling feature of Epic from day one. Cerner has worked really hard to get an integrated record that works across care settings. MEDITECH's Expanse platform now has the same thing. Fully integrated solutions have become a base level of expectation.

If there is any disconnect where the solution works great in one setting but not so much in another setting, that solution is not a viable option anymore. In fact, we noted right out of the gate with this report that buyers are unwilling to settle. What Epic used as their prime selling feature is now the minimum requirement, and a vendor’s product must be integrated to even be considered.

Including the Smaller Facilities

Clearly, integration has been an expectation from huge hospitals. But even small 25-bed hospitals in the middle of nowhere are saying that they want a fully integrated record. I have example after example of small facilities that are almost an afterthought for most vendors and yet have the same level of expectation as the 1,500-bed hospital in downtown New York.

I don’t want to speak for vendors, but I think at least some of them put their A-team only on the big opportunities. But the medium and small hospitals are now expecting the same level of care and treatment from the sales and implementation teams. Again, I'm not a vendor, but I wouldn't have a large, medium, and small team anymore. I would try to create a more consistent experience across the board. I would never want an organization to feel like they were sent the B-team because their hospital wasn’t as big of an opportunity.

The Direction of Acute Care EMR Solutions

As we look to the future, hosted or SaaS options (essentially options that aren't on premises) are increasingly viable options. Providers are really considering Cerner-hosted scenarios or Epic solutions hosted by a local hospital partner. I also think that's one of the reasons why athenahealth’s and MEDITECH's EMRs are gaining traction. Though the report doesn’t focus on that, hosting options are becoming important.

To get an overall sense of what is currently happening in the acute care space, we put together a sort of buyer’s guide with overall scores and other trends for each vendor. Some of these trends include supporting integration goals, ease of use, and market energy. To see the overall score breakdown for each vendor we researched, I encourage you to look at the full report.

Photo cred: Shutterstock